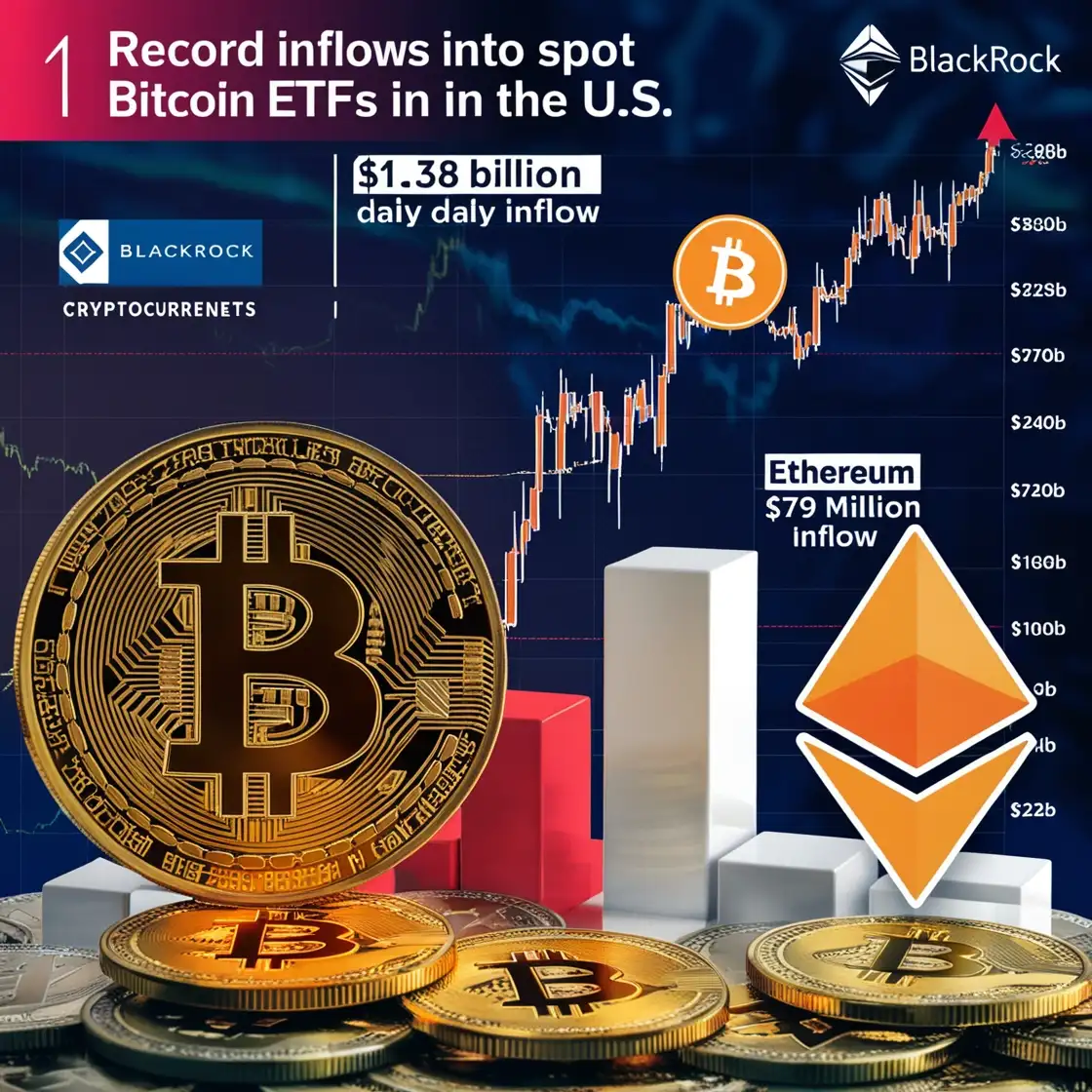

On November 7, 2024, spot Bitcoin exchange-traded funds (ETFs) in the United States achieved a remarkable milestone by recording an astounding $1.38 billion in daily inflows. This figure marks the highest single-day inflow for Bitcoin ETFs since their inception, reflecting a surge of interest from institutional investors and traders alike.

Factors Driving the Surge

The record inflow coincided with Bitcoin’s ascent to a new all-time high just below $77,000, driven by several key factors:

- Market Sentiment: The recent victory of Donald Trump in the presidential elections has reignited optimism among crypto investors. Trump’s pro-cryptocurrency stance and his promise to restore regulatory balance have contributed to heightened market confidence.

- Interest Rate Cuts: The U.S. Federal Reserve’s decision to lower interest rates has also played a significant role in boosting investor sentiment. With lower borrowing costs, investors are more inclined to allocate funds into riskier assets like cryptocurrencies.

- Strong Performance of Leading ETFs: BlackRock’s iShares Bitcoin Trust (IBIT) led the charge with an impressive $1.12 billion in inflows, accounting for over 80% of the total inflow across all spot Bitcoin ETFs on that day. Fidelity’s Bitcoin ETF (FBTC) followed with $190.9 million, marking a significant uptick in interest for these investment vehicles.

Broader Market Impact

The total amount invested in U.S. spot Bitcoin ETFs has now reached approximately $25.5 billion since their launch earlier this year. This influx is indicative of a growing trend where institutional investors are increasingly favoring ETFs as a means to gain exposure to Bitcoin without the complexities of direct ownership.

In addition to Bitcoin, Ethereum ETFs also saw notable activity, attracting $79 million in inflows—one of the largest figures since their introduction. This growing interest in Ethereum-based funds highlights an expanding acceptance of cryptocurrency investment products among traditional investors.

Implications for the Future

The unprecedented inflows into Bitcoin ETFs signal a robust demand for cryptocurrency investment options and may set the stage for further growth in the sector. Analysts suggest that as regulatory clarity improves and more financial institutions embrace digital assets, we could see continued strong performance from both Bitcoin and Ethereum ETFs.

Moreover, with over 1 million bitcoins now held by U.S. spot Bitcoin ETFs, these funds are on track to surpass even the holdings of Satoshi Nakamoto, the mysterious creator of Bitcoin.

Conclusion

The record inflows into spot Bitcoin ETFs reflect a significant shift in market dynamics as institutional interest surges amid favorable economic conditions and political developments. With continued support from major players like BlackRock and Fidelity, along with a favorable regulatory environment, the future looks promising for cryptocurrency investment vehicles. As more investors seek exposure to digital assets through these innovative financial products, we can expect ongoing growth and evolution within the cryptocurrency market.