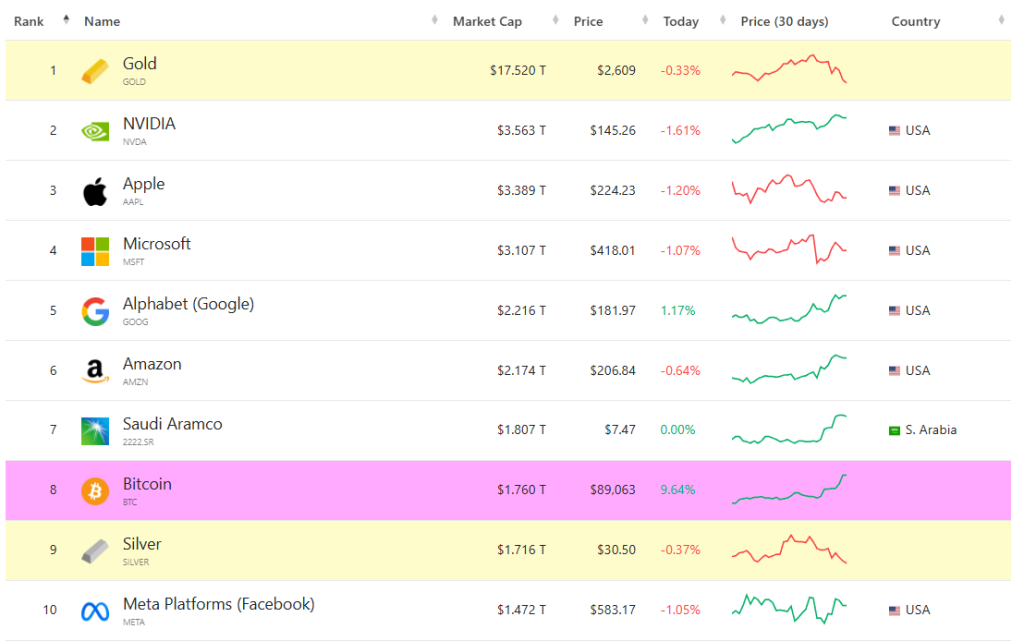

Awash with presumptions, Bitcoin has not only surpassed silver in market capitalization, but evidently has matched a new height as the eighth largest asset in the world status now. As of November 12, its market value touched close to $1.78 trillion, earmarking another significant landmark to its digital currency journey.

A Record-Breaking Surge

On this date, Bitcoin attained an extraordinary new peak value, surpassing $89,000. This surge isn’t a fleeting rise; it mirrors a wider trend of growing institutional engagement and market assurance. In a mere seven days, Bitcoin’s worth surged past $400 billion, underscoring its rapid expansion rate. The digital currency has surged, capturing an extraordinary 101% yearly yield, reflecting its robustness and market allure amidst fluctuating economic conditions.

Institutional Interest Fuels Growth

The recent rally can be attributed to several key factors. Robust institutional interest has propelled Bitcoin’s climb. Significantly, notable trading quantity from prominent entities such as BlackRock’s iShares Bitcoin Trust escalated to a remarkable $4.5 billion within a single day. This surge of wealth accentuates the increasing endorsement of Bitcoin as a credible investment instrument.

Moreover, the political tableau has significantly influenced market apprehension. Following the recent triumph of Donald Trump, enthusiasm escalated among the cryptocurrency circle. Experts suggest that Trump’s positive attitude toward cryptocurrencies might result in beneficial legal adjustments, boosting the expansion of Bitcoin. Many specialists concur that should the present patterns persist, Bitcoin might possibly hit the $100,000 valuation by mid-2024’s close.

The Road Ahead: Challenging Giants

With its evolved stature, Bitcoin is now aiming at even more larger goals. Behind it lies Saudi Aramco, Earth’s most sizable petroleum corporation, with a market valuation close to $1.8 trillion. If Bitcoin achieves prices over $91,000, it could readily outpace Aramco and target tech behemoths such as Amazon and Google.

Nonetheless, despite Bitcoin’s notable ascension, it trails considerably compared to gold, boasting a colossal market valuation of approximately $17 trillion, almost tenfold that of Bitcoin’s. Experts propose that for Bitcoin to surpass gold as the world’s preeminent asset, its value would need to soar to nearly a million dollars per unit. Although this may appear unrealistic now, certain industry futurists surmise it could materialize in the current decade.

The Broader Implications

Bitcoin’s rise surpasses silver numerically; it marks a change in the valuation of digital assets within the wider economic landscape. As organizational integration escalates and legal structures adapt, digital currencies such as Bitcoin are set to assume a more pivotal function in international monetary systems.

Despite the enthusiasm regarding Bitcoin’s recent execution, experts advise that fluctuation persists as an unwavering element in this domain. Elements such as economic indicators at a macro level and prospective regulatory adjustments might impact forthcoming pricing trends considerably.

Conclusion

In summary, Bitcoin’s overtaking of silver signifies a critical juncture in its chronicle and mirrors the increasing acknowledgment of digital currencies as legitimate participants in worldwide finance. As Bitcoin keeps setting new highs and gains attention from big investors, everyone will watch to see how high it can go as a worldwide asset. The voyage forthcoming shall be electrifying as this electronic resource endeavors to reconstruct its position within the fiscal terrain.